The Gold Rush

The word cannabis may conjure up images of a social revolution in the ‘60s and ‘70s or make you think of medications that ease the effects of glaucoma or chemotherapy. But for an increasing number of retailers and consumer packaged goods (CPG) companies, cannabis has also become associated with a potential multibillion-dollar opportunity, anchored by a portfolio of cannabis-based products ranging from beverages and OTC drugs to cosmetics, skincare items, and beyond. As modern technology supports the individual extraction of THC (the psychoactive, euphoric cannabinoid) and CBD (the non-psychoactive, therapeutic cannabinoid), expanding the potential uses of cannabis, pundits are predicting the creation of not just new segments but entirely new categories, creating significant potential for companies across the value chain.

That potential is affected by the speed of legalization efforts and the degree of consumer acceptance—twin paths that are highly volatile, risky, and uncertain.

Legalization continues, however, as Canada recently became the first G7 nation to legalize both medical and recreational cannabis on a federal level and the second nation in the world; Uruguay legalized recreational cannabis in 2013. The world now watches to see how legalization comes to shape a burgeoning market in a developed nation, gleaning lessons and experiences that will create distribution models, product portfolios, and investment strategies. Select Fortune 500 companies have already entered the Canadian market through joint ventures and strategic investments to capitalize on the opportunity and develop expertise to be prepared if, and more likely when, cannabis becomes legalized federally in other developed nations. While Canada is close at hand, it is the larger US market that is the real prize.

So, with a tremendous market opportunity supported by increasing consumer acceptance, how do CPGs and retailers capitalize on the opportunity presented by cannabis-based products without being caught up in the regulatory undertow or overestimating the addressable market?

Size of the Prize

Acceptance of cannabis products has grown exponentially. As of September 2018, 22 countries and 31 US states have legalized the use of medical cannabis. The emerging global corporate cannabis industry sees Canada as a test case to determine where market opportunities exist and how fast they develop and to craft best-practice brand marketing, production, operation, and distribution models.

Cannabis legalization has created a 21st-century gold rush, replete with an army of speculators, evangelists, pioneers, and—of course—temperance advocates and prophets of doom. Entrepreneurs and venture capitalists comfortable with building and navigating nascent markets have already gained first-mover advantage, establishing a broad range of cannabis-based products and brands in categories from cosmetics and skincare to pet food and beverages. And the opportunity is proving too great for many Fortune 500 companies to ignore.

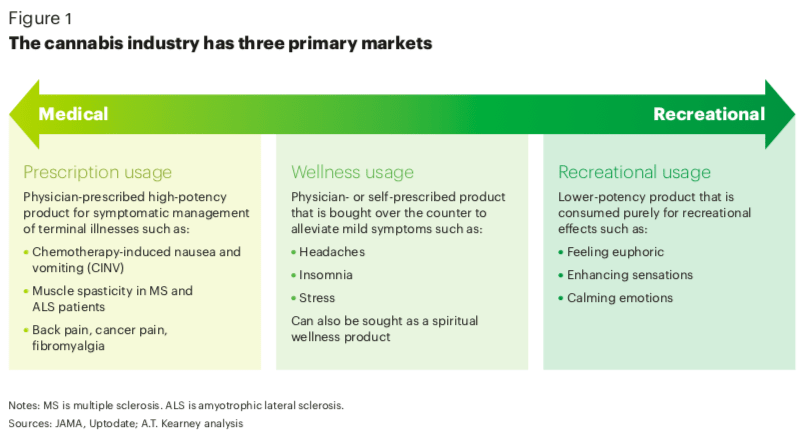

No opportunity comes without risk, however. Using Canada as a case study in progress, A.T. Kearney has developed a clear point of view on how to balance the risks and rewards of the emerging cannabis market, and on lessons that can be transferred to other markets, most notably the United States. We began by categorizing the legal cannabis industry into three markets—medical, recreational, and supplemental and therapeutics (see figure 1 on page 2).

Medical Cannabis

Medical users represent roughly 75 percent of the current legal global cannabis market, although in places where recreational use is not legal, it’s probably safe to assume that many “medical” users are, in fact, recreational users. The growing interest in cannabis’ medical potential has increased research funding and, as a result, new applications continue to emerge.

Preliminary research has found cannabis to be an effective secondary treatment, alleviating symptoms such as chemotherapy-induced nausea and vomiting (CINV), chronic pain, spasticity, appetite loss, and more. The debate on the benefits and risks of long-term cannabis use remains ongoing in the research community.

Medical and therapeutic research is one of the main drivers fueling the growth of the cannabis industry. Israel and Canada are leading global research; the United States lags because of cannabis’ status as a schedule 1 controlled substance. The status of cannabis in the US greatly limits research growth and this area will need to be resolved before the industry can truly blossom. Given current trends, A.T. Kearney expects the list of recognized cannabis treatment areas to expand and medical communities and affiliates in select countries to become more accepting.

As medical uses of cannabis proliferate in Canada, insurers such as Sun Life Financial and Manulife, two of the nation’s largest insurers, have already begun to offer subscribers the option to add medical cannabis coverage to their extended healthcare plans.

Recreational Cannabis

Recreational users are interested in attaining some level of a “high”—a point on the psychoactive continuum that begins with relaxation and calmness and extends to somewhere between euphoria and anxiety.

The recreational usage of cannabis—associated by many with the larger drug culture and troubling social issues—is the source of much of the public’s negative impression of cannabis.

Bogus research, racist fearmongering, and an amazingly effective media effort through films such as Reefer Madness—a cult favorite today—buoyed efforts for criminalization. Ironically, they also ended up costing governments billions in potential tax revenue, a fact not lost on today’s lawmakers. For example, Washington state has a 37 percent sales tax on cannabis, and Oregon’s cannabis sales tax (the state does not have a general sales tax) is 17 percent. Full legalization would close this tax loophole and likely reduce illegal sales in the process. With an estimated global market size of about US$50 billion in 2020 and a CAGR of about 45 percent, there is abundant opportunity for governments to carve out their fair share of the recreational cannabis revenue pie, estimated to be US$132 billion by 2030.

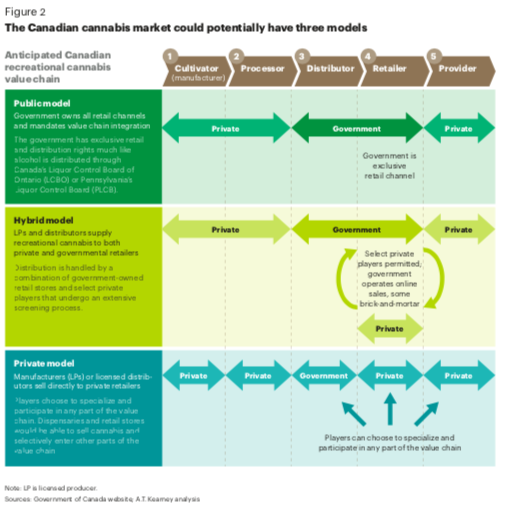

Developing a healthy cannabis market holds out a good deal of promise for both government and industry, but realizing it requires leaders to study all aspects of the business—regulating cost, approving distribution models, establishing advertising rules, and promoting fact-based consumer education. In Canada, for example, the sales and distribution channels will be provin- cially regulated like alcohol, creating the potential for public, hybrid, and private models to be executed differently from province to province (see figure 2).

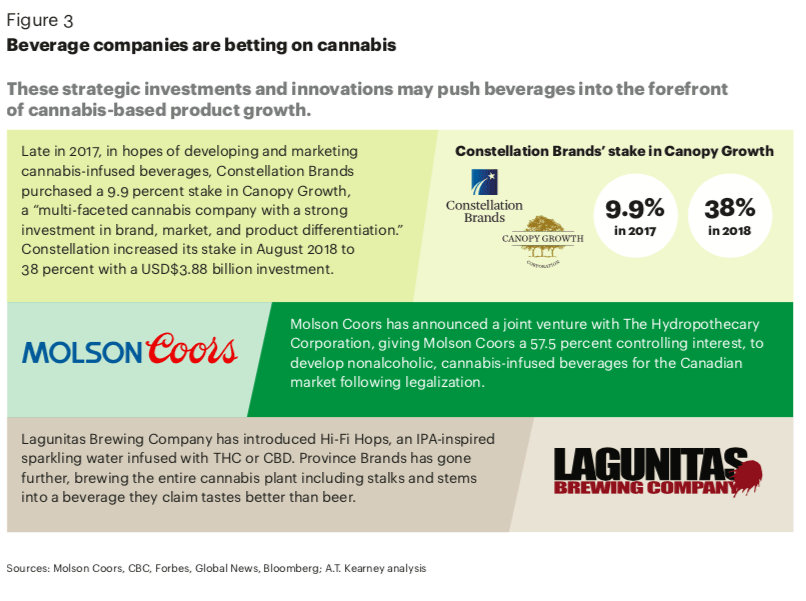

Not surprisingly, given cannabis’ potential to grow or cannibalize alcoholic beverage categories, beverage companies have been among the first large-scale businesses to place strategic bets on the industry, especially breweries that recognize that cannabis beverages could either expand the adult beverage market or take significant sales away from traditional brands (see figure 3).

Cannabis Supplements and Therapeutics

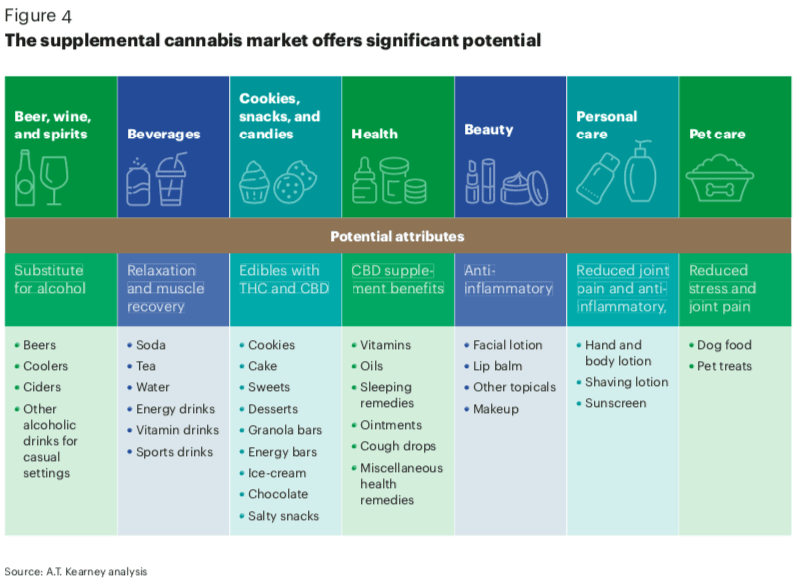

Based largely on anecdotal user experience, a variety of supplemental cannabis-infused products—intended to enhance wellness in daily lives—are emerging from the recreational market. These products are not intended to get users high or treat medical conditions requiring a prescription, but to deliver beneficial properties by acting as anti-inflammatories, relaxants, or sleeping aids.

“We believe that the growth of the global legal cannabis industry will be driven by increasing penetration in largely untapped “mainstream” consumer markets, and that the legal industry could grow to more than two times the estimated size of the current illegal market.” —Ackrell Capital

The supplemental cannabis market is potentially the most dynamic and commercially interesting product segment. It operates across categories from CPG to beauty and personal care to pet care and retail pharmaceuticals. Traditional categories such as beverages, snacks, and health and beauty will see new opportunities emerge as legalization progresses (see figure 4).

Emerging Dynamics: The A.T. Kearney View

The potential of the Canadian cannabis market is evident, and while full legalization in the US would be commercially even larger, the risks and volatility surrounding legalization are significant.

A.T. Kearney expects the following developments:

Canada will be in the spotlight. As we noted earlier, Canada will legalize recreational cannabis on October 17, 2018. The Canadian federal and provincial governments have studied the successes and failures of US state legalization in Colorado, Washington, and, most recently, California, hoping to learn from the experiences of others. Global investors, government officials, and the media will all be watching Canada to see how a large-scale rollout unfolds.

It will not be one market. Cannabis legislation in both Canada and the United States is progressing state by state, province by province. Each jurisdiction is different, with varying approaches to cultivation licenses, testing certification, and retail formats. Local municipalities setting their own rules (and tax levies) at a local level adds to the confusion in states such as California and Massachusetts. Expect a jumbled and non-uniform business environment.

Hemp-based CBD will emerge as the market test. For many CPG companies, a hemp-based product introduction can test the market. While hemp-based products are not as effective as full-spectrum cannabis-based products, they can still provide therapeutic properties and will be legalized through the US federal farm bill. The hemp-derived CBD category has experienced explosive growth from a market category that did not exist five years ago to an expected $1 billion market in 2018 driven by hemp-derived CBD food, personal care, and industrial products.

Changes and wild cards will be frequent. The past six months have seen dramatic reversals on regulations, and additional volatility can be expected as states and provinces grapple with local and federal regulation shifts. Expect more wild-card decisions such as changes in US federal legislation, changes to Canadian provincial jurisdictions, and new medical evidence and media coverage that could promote or discourage public perception and further usage.

Industry consolidation will take place. Many market entrants active in areas from cultivation through retail will fail to gain scale or profitability as the fragmented market becomes more saturated with private and public players. Significant funds are being routed to the space, initially in Canada, but the US will follow as it continues to legalize. Though independent brands have popularized the space, larger, more-established players will smell the opportunity and place their own strategic bets.

“When you’re doing stuff at this scale you start to think about things like beverages, vape pens, and chewables very differently. There’s a whole range of things you’ll start to see in our product offering in 2019, and that should increase margins because you’re not really selling just cannabis—you’re taking it and putting it into something else, which usually means much better margins.” —Bruce Linton, Canopy Growth Founder, Chairman, and Co-CEO

Innovative products will appear. Over the past few decades, many people have stopped smoking tobacco products due to health concerns and the availability of alternatives. We expect that while smokable cannabis will be one of the first products on the market, many consumers will opt for edibles, beverages, and even alternatives to smoking such as vaping.

Ancillary products and services will flourish. Using the gold rush as an analogy, the ones that made the most money weren’t necessarily the ones that mined the gold, but rather the ones that supported the movement with ancillary products such as pails and shovels. Given that the cannabis industry is just starting to grow, we can expect associated industries such as acces- sories, security, and product lab testing to flourish as well.

Winners and losers will emerge. There are many new companies, products, and services entering the market from celebrity-endorsed products to novel food and beverage items. Most will fail. We are seeing some of these first-entry public companies face intense market valuation fluctuations and questions regarding their underlying business models. Players investing in the long game must be prepared to remain focused and resolute. Management teams that can weather the eventual volatility and shifting regulatory requirements will be highly prized.

The Bottom Line

The cannabis market will not settle in the near term.

Today, Canada is ground zero for tracing the development of what could easily grow into a new billion-dollar-plus industry. If you are in any consumer-facing industry, at the very least that ought to merit a concerted, objective look.

There are smart and calculated ways to test and keep pace with the market through minimal-risk, low-cost market learning and development trials. CPGs and retailers will do well to bear in mind the following:

Know your customer and understand perception. Integrating cannabis products into existing portfolios or launching new products altogether are bound to impact brand perception and corporate reputation. Tailor your product, branding, and communications to develop the desired narrative.

Keep a finger on the pulse. With rapid acquisition and quick product development cycles, the pace of change in the cannabis ecosystem is staggering. Attending conferences such as MJ Bizcon, Lift & Co., and Cannabis World Congress will provide a snapshot view into where smaller, nimbler start-ups are driving the market, and offer networking opportunities to support future product and SKU selection or acquisition targets.

Explore tangential opportunities. The market opportunity is wider than just cannabis products. Firms offering expertise in cannabis processing, packaging, supply chain, and branding will grow to become leaders in their respective fields as the market further develops.

Place strategic bets. In a market saturated with companies, ensuring partnerships and placing investment dollars wisely will be imperative for success. Proven management teams with pharma and CPG expertise and tight controls will have an advantage.

An Eye to the Future—and the Past

The emergence of this new market reflects the development of now billion-dollar markets: frozen foods, personal computing, smartphones, and a plethora of food and beverage categories—opportunities that reward those with vision and an eye for the long game.

Whether you plan to place small investments in existing companies or use the hemp CBD market as an indicator of potential growth, product innovation, supply chain operationalization, strategic investments, and an eye for opportunity can change the game.

_____

Disclaimer

Possessing, using, distributing, and/or selling marijuana or marijuana-based products is illegal under federal law, regardless of any state law that may decriminalize such activity under certain circumstances. Although federal enforcement policy may at times defer to states’ laws and not enforce conflicting federal laws, interested businesses and individuals should be aware that compliance with state law in no way assures compliance with federal law, and there is a risk that conflicting federal laws may be enforced in the future. No industry perspectives, analysis, or advice we give is intended to provide any guidance or assistance in violating federal law.