It’s 11 a.m. on a rainy Thursday morning and hundreds of Canopy Growth Corp. employees are shuffling into work at the company’s facility in Aldergrove, B.C.

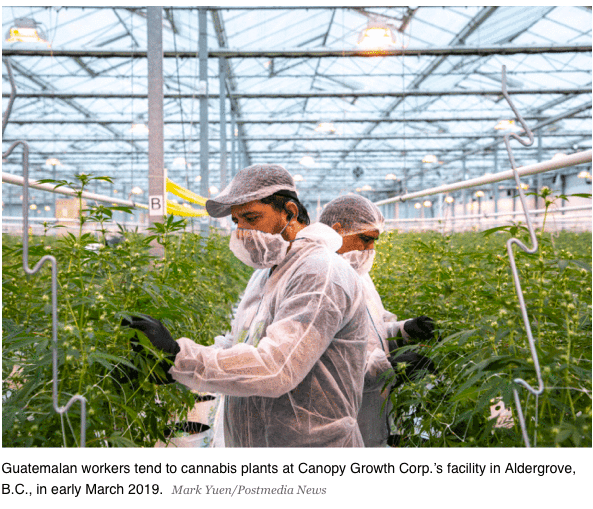

After first donning Health Canada-mandated scrubs, lab jackets, hairnets and booties, they enter one of the facility’s massive greenhouses, where they’ll spend the next eight hours tending to thousands of cannabis plants.

The atmosphere inside is upbeat. Workers laugh and chat, mostly in Spanish or Punjabi, and the energetic beat of Bhangra music blasts from a bluetooth speaker, reverberating across the expansive greenhouse.

At 400,000 square feet apiece, the three greenhouses in Aldergrove are so large you can barely see to the end of them.

Together they account for one-third of Canopy’s licensed growing space, making Aldergrove one of the centrepieces of the company’s ambitious growth strategy, which has seen it acquire giant greenhouses at a frenetic pace over the past five years.

The promise of producing legal cannabis on a mass scale has helped catapult Canopy to the top of the rapidly expanding industry: With a market value of almost $20 billion, it is the largest cannabis company in the world.

But if Aldergrove is emblematic of Canopy’s ambitions, it has also become a source of concerns over just how well the company is progressing toward the lofty goals it has set for itself and promised investors.

For months, whispers have circulated throughout the cannabis world about a brief video, purported to have been shot at the facility,that showed thousands of dead cannabis plants.

At least three people deeply involved in the cannabis industry — two of whom said they had visited the Aldergrove facility — told the Financial Post, on condition of anonymity, that the ramp-up at Aldergrove has been bumpy.

“It has not been a smooth transition from back when it was growing vegetables, to growing cannabis,” one person, who had visited the facility, said.

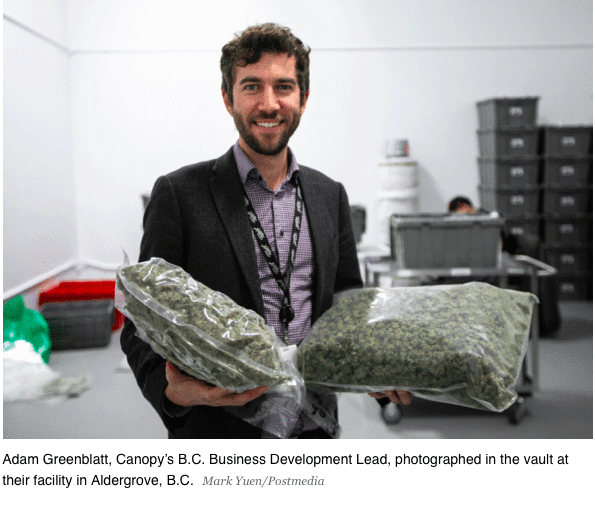

When the Financial Post visited Aldergrove in early March, one out of three greenhouses appeared to be in full use, housing thousands of plants, about five to six weeks old.

A second, known as Phase 2, was empty: Adam Greenblatt, the company’s B.C. business development lead, said it was between harvests, a process that typically takes up to three weeks.

The third greenhouse was still being retrofitted to accommodate cannabis cultivation.

The questions about Aldergrove come as Canada faces a severe cannabis supply shortage more than six months after recreational legalization, and four years after Canopy first started cultivating marijuana.

Canopy has publicly acknowledged hiccups at the facility, saying last fall that a number of plants had to be destroyed due to delays related to “infrastructure” and “regulatory approvals,” but it has insisted the plant deaths were not related to growing issues.

For a company whose chief executive, Bruce Linton, has said the goal all along has been to be No. 1, the stakes at Aldergrove are high: Getting the facility fully up to speed would go a long way toward silencing the company’s doubters.

But it remains a work in progress.

By square footage owned — and most other measures — Canopy is a behemoth in the cannabis world. The company has 4.4 million square feet of licensed cultivation space to its name, stretching across seven provinces.

British Columbia, infamous as a bastion of cannabis culture and long renowned as a source of black market supply, is central to this equation.

The 1.3 million square foot Aldergrove facility and another 1.7 million square feet of space in Delta make up two-thirds of Canopy’s total licensed operations.

Both B.C. facilities, which operate under the BC Tweed banner, were acquired in early 2018 from the Krahn family, longtime greenhouse operators who have been growing vegetables in the province for decades. It was a $400 million investment that the company touted as its ticket to “cementing shareholder value through scale production,” according to a May 2018 press release.

“The BC Tweed greenhouses represent a meaningful share of the entire Canadian production landscape,” Canopy said at the time.

Aldergrove received its cultivation licence in February of that year, and Delta was given the green light to start growing just two months later.

According to Greenblatt, Canopy also hired a large number of workers — primarily from Guatemala — through the federal government’s Temporary Foreign Workers program. The idea behind getting labour and licensing in order was to have a six-month head-start on cultivation in the two massive sites in order to be primed with thousands of kilograms of fresh bud in time for recreational legalization in October of last year.

But in late September 2018, Canopy put out what appeared to be a rather benign press release addressing Ontario’s retail rollout plan, which had just been announced.

Buried six paragraphs deep in the release was an acknowledgement that the company had destroyed a number of plants at its B.C. facilities (it did not specify which one) due to “licensing delays.”

“Processing licences were delayed by infrastructure and regulatory approvals, which led to a number of plants needing to be destroyed. Management does not consider this event to represent a material impact on the company’s balance sheet,” the Sept. 27, 2018 statement read.

Less than two hours later, a video showing a large greenhouse full of dead cannabis plants started circulating on Twitter and Reddit. On social media, many commenters, including some claiming to be investors in the cannabis space, speculated that it showed a crop failure at a greenhouse at Canopy’s Aldergrove facility — and not a deliberate crop cull.

Although Canopy has never divulged what prompted it to release details of destroyed plants just a few weeks before legalization, an internal email sent by Canopy’s president and co-CEO Mark Zekulin to employees on Sept. 28, 2018 made reference to the video.

“From U.S. border crossings to successful $5 billion AGM shareholder votes, we always have something going on to talk about. Most of the time ours is a good news story. Today the story was somebody who thought they should take a video in allegedly one of our greenhouses, and create a misleading perception of our company out there, undermining the good work all of us are doing around the globe to build a world-class company,” the email, obtained by the Financial Post, read.

“In the case of BC, our regulator provided a licence to grow, but the licence to process did not show up when we wanted to start the harvest. We can’t put it all on Health Canada, as we had our own delays and challenges getting these incredibly massive facilities up and running, but it sure didn’t help. As a result, we have sadly had to kill tens of thousands of plants that we could not harvest,” the email continued.

In a phone interview with the Post, Jordan Sinclair, Canopy’s vice-president of communications, addressed the video publicly for the first time.

When asked if it depicted a greenhouse in the Aldergrove facility, Sinclair said, “That is an excellent question.”

“Clearly people have seen the video, we have gone through video records to try and verify where that footage came from,” Sinclair said. “I would say I think it lines up with timelines, but even internally, I would not say that I can confirm that is our site.”

When asked specifically if Canopy ever faced crop loss in Aldergrove, Sinclair was adamant that they had not.

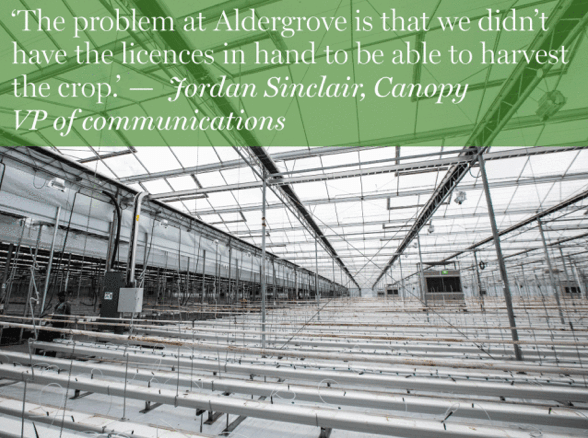

“We have not experienced crop failure at Aldergrove. The problem at Aldergrove is that we didn’t have the licenses in hand to be able to harvest the crop.”

Linton, too, reiterated to the Post via text that there had been no crop failure at the site.

Cultivating cannabis in massive greenhouses, at such scale, has never been done before and is bound to come with its fair share of challenges.

This may be why Canopy, like many other cannabis companies, does not publicly specify the quantity of cannabis produced at each of its operations across the country. The way the company tends to measure its operational scale is by square footage — although the company owns 4.4 million square feet of licensed production space, it is not clear how much cannabis flower and oil that actually yields.

According to Greenblatt, each 400,000-square-foot greenhouse in Aldergrove can produce 5,000 kilograms of cannabis in one harvest cycle — the growers anticipate that in a given year, there will be three-and-a-half cycles, meaning that at full capacity, the facility could produce up to 52,000 kg of cannabis.

But Greenblatt also confirmed that the most recent harvest out of Aldergrove in February (from a single greenhouse) yielded just 1,200 kg of cannabis. When asked about the shortfall, he said that much of that specific greenhouse was used as a nursery to house mother plants and test out different kinds of genetics.

“Greenhouses across North America have had a difficult time adjusting to growing cannabis at scale,” said Jason Zandberg, a special situations analyst at PI Financial who has observed and documented the cannabis industry for almost four years.

“The appeal of greenhouses is their low cost of production. But they are much more difficult to get right. I’ve seen greenhouses that used to grow chrysanthemum flowers and bell peppers having problems because cannabis is a much trickier crop,” he explained.

One anonymous source told the Financial Post that the Aldergrove site has faced “lots of problems” and is struggling to grow at capacity even though large parts of it have been in operation for more than a year. He also said he had seen a “sea of brown plants” in one of the greenhouses during a visit in the latter half of last year.

Another source, who said he visited Aldergrove last year, said a Canopy employee told him that one greenhouse had been battling a “root rot problem,” a fungal infection that afflicts cannabis roots that are weaker or stressed.

According to Sinclair, the characterization of Aldergrove having a “sea of brown plants” at one point, was “not accurate.”

“I would say that even at the point where we had to make that very difficult decision to destroy some of the plants due to the licensing and infrastructure delays that we disclosed, the vast majority of that site was in great health and has formed the backbone of the sales that we have put into the recreational market,” he added.

Sinclair also denied that the facility, or any of Canopy’s cultivation sites had experienced “root rot,” but acknowledged that the company has had plants with “poor health” in the past.

“I don’t think it is fair to say there have been lots of problems at Aldergrove. I think it is fair to say that it is a difficult task to bring 1.3 million square feet of cannabis production online in a short period of time. So it has not been a flawless process,” he said.

Then there is the question of Canopy’s licensing with Health Canada. In both Aldergrove and Delta, Canopy only has a cultivation licence from the government, meaning that once harvested, cannabis cannot be processed or packaged at BC Tweed.

Cannabis facilities typically apply for cultivation, processing and sales licences, in order to grow, package and sell their product.

But in order to obtain a sales licence, LPs first have to apply for a processing licence, and then go through a thorough multi-day inspection of their processed products.

“Typically, the inspectors want to see that you’ve gone through the whole processing, testing, labelling and packaging process with at least two distinct lots of cannabis,” said Trina Fraser, a cannabis lawyer with Brazeau Seller LLP.

It is still not clear whether Canopy had applied for a processing or sales licence in the past for its BC Tweed facilities under the Access to Cannabis for Medical Purposes Regime or under the Cannabis Act. In separate conversations, neither Sinclair nor company spokesperson Caitlin O’Hara directly responded to those questions.

But both Canopy in its Sept. 2018 press release and Zekulin in the internal email attributed the destroyed plants to a delay in obtaining what they termed a “processing” licence.

According to publicly available information on Health Canada’s website, Canopy’s Aldergrove facility still does not have a processing or sales licence.

Most major LPs, including Tilray Inc., Aphria Inc., and Aurora Cannabis Inc. have cultivation, processing and sales licences at least in their biggest facilities.

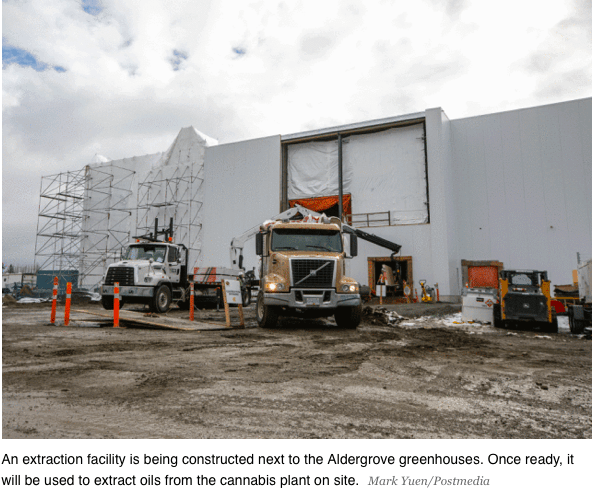

But Canopy is currently shipping unfinished product to its headquarters in Smiths Falls, Ont., in order to be processed and packaged, an unusual strategy that the company says is deliberate.

“What we were waiting for at that time when the plants were destroyed, was permission to harvest the plant. I guess what I should say now, is that all of the licences are complete. The model at BC Tweed is that a cultivation licence is all we need to conduct business,” Sinclair said.

According to Zandberg, under the Cannabis Act, Health Canada does allow licensed producers to move product between their facilities — that was not the case under the previous Access to Cannabis For Medical Cannabis Regime (ACMPR).

“It’s definitely not conventional, but it’s allowed,” Zandberg said.

Until recently, Canada’s biggest licensed producers have watched their valuations sky-rocket well into the billions of dollars, driven not by actual sales of cannabis, but mostly by investor euphoria, hypothetical forecasts of demand and the domino effect of major sector-wide deals.

Canopy has dominated coverage of the sector, often making the first and biggest splashes when it comes to new trends and developments.

Analysts covering Canopy, too, have for the most part maintained an optimistic outlook on the company.

But that appears to be slowly changing, as the market looks to Canopy, along with most other licensed producers, to start delivering on their mammoth investments.

After its most recent quarterly earnings were released, reflecting the first three full months of adult-use sales, a number of analysts expressed concerns about Canopy’s product stockpile and low margins.

“We are concerned by the company’s low inventory levels and believe that it could impair its ability to sustain near-term growth. In our view, Canopy’s competitors could catch up with better inventory availability and significant capacity expansion plans,” wrote Martin Landry, an analyst at GMP Securities Ltd.

Matt Bottomley, a long-time analyst covering the sector at Canaccord Genuity Corp. observed that his team was “discouraged” to see Canopy “take a further step back from reaching profitability” due to low inventory and high production costs.

“Canopy is still a position we hold, although it is not as big as it used to be,” said Greg Taylor, who is chief investment officer at Purpose Investments and also manages the firm’s marijuana fund.

“My issue with Canopy is two-fold. First, they are not scaling up as quickly as I thought they would, and from an economics point of view, they have pretty much sold control to Constellation Brands. Hard to make them our top pick,” Taylor said, referencing the $5-billion investment in November by U.S. alcohol giant Constellation, which gave it the option eventually push its stake in Canopy to 50 per cent.

But at least in Canada, Canopy is still the cannabis company raking in the most revenue.

In its most recent financial quarter, Canopy brought in $83 million, which mostly came from the sale of over 10,102 kg of cannabis. Although its harvest rates have fluctuated between quarters, they have generally been on a sharp upward trajectory — in 2018, Canopy harvested as much as 40,000 kg of cannabis, according to corporate filings.

By contrast, the company’s closest competitor, Aurora, which says it is operating at an annualized production rate of 120,000 kilograms, produced just over 16,000 kg in 2018. In terms of sales, the Edmonton-based producer sold 7,000 kg of cannabis, bringing in revenue of $62 million in their most recent quarter.

“Look, I think the bottom line here, when you look at all of these companies, is that it is much harder to mass produce cannabis than everyone expected,” Taylor said.

“That, to me is a risk for the whole sector. They came out with these monster growth numbers, but not a single big licensed producer has been able to deliver on them yet.”

Click link below to view full article published in The Financial Post April 4th, 2019: